🚨 BREAKING — Chicago Mayor Brandon Johnson Sparks Outrage With “Head Tax” Proposal That Punishes Employers for Hiring Workers

Chicago is in turmoil after Mayor Brandon Johnson announced a controversial new plan to reintroduce a so-called “head tax” on large employers — a move that business leaders are calling “economic suicide” and “a direct attack on job creation.”

The proposal, unveiled during a tense City Hall press briefing Monday afternoon, would impose a $21-per-employee monthly fee on every business operating in Chicago with more than 100 workers — regardless of industry or revenue.

Johnson argued that the tax is part of a broader initiative to “restore fairness and fund essential city services,” claiming the measure would generate tens of millions of dollars annually to help close the city’s widening budget deficit.

“For too long, Chicago’s biggest corporations have reaped the benefits of our city’s infrastructure and workforce without paying their fair share,” Johnson said. “It’s time to reinvest in the people who make this city run.”

But critics across the political spectrum wasted no time blasting the plan, calling it a job killer that could drive more employers — and taxpayers — out of the city for good.

A Tax With a Troubled History

The so-called “head tax” is not new to Chicago.

The city first implemented a similar measure in 1973, charging large companies a small fee per employee to raise revenue.

For decades, the policy was a lightning rod for controversy, accused of stifling growth and deterring investment.

In 2014, then-Mayor Rahm Emanuel officially repealed the tax, calling it “a job killer that discourages businesses from putting down roots in Chicago.”

Now, just over a decade later, Johnson is reviving it — though this time, with a higher price tag and an expanded scope.

“This is déjà vu all over again,” said Michael Reilly, a downtown business owner and member of the Chicago Chamber of Commerce. “We fought to get rid of this tax years ago because it punished employers for hiring people. And now it’s back — worse than before.”

Business Leaders Sound the Alarm

Reaction from Chicago’s business community was swift and furious.

The Illinois Retail Merchants Association called the measure “an act of economic self-sabotage.”

The Chicago Chamber of Commerce warned that the policy would “undermine job growth and push mid-sized companies to relocate.”

“This isn’t a tax on profits — it’s a tax on employment itself,” said Chamber President Jack Lavin. “Every new worker becomes a liability, not an asset. That’s not how you build a strong economy.”

Manufacturing and logistics companies, many already burdened by rising property taxes, energy costs, and crime-related losses, say the measure could be the last straw.

A spokesperson for UPS, which employs over 2,000 workers in the Chicago area, said the company is “reviewing the proposal closely” but warned that additional costs “could force difficult decisions.”

Even some small business coalitions, though technically exempt under the 100-employee threshold, expressed fear that the tax could trickle down to them through higher costs and reduced consumer spending.

City Hall Defends the Plan

Mayor Johnson’s office insists the tax is necessary to stabilize city finances, fund public safety initiatives, and support social equity programs.

According to City Budget Director Melissa Conyears-Ervin, the “head tax” could generate up to $150 million annually, depending on how many businesses remain within city limits.

“We’re not targeting job creators,” Conyears-Ervin said in a follow-up briefing. “We’re asking the largest corporations — many of which have enjoyed record profits — to contribute a modest share to help maintain Chicago’s services, infrastructure, and community programs.”

Johnson has also framed the move as a step toward economic justice, arguing that corporations benefit from public resources but often relocate profits out of the city or state.

“Working people in Chicago have carried the load for too long,” Johnson said. “This is about balancing the scales.”

Still, his remarks did little to calm the storm brewing among local employers and state legislators.

Political Fallout: Allies Divided

Even within Johnson’s progressive coalition, the proposal is proving divisive.

Several city aldermen who typically support the mayor’s agenda are hesitant to endorse the plan, fearing backlash from constituents who depend on major employers.

Alderman Brian Hopkins (2nd Ward) called the proposal “well-intentioned but dangerously shortsighted.”

“You don’t strengthen a city by punishing its job creators,” Hopkins said. “If the goal is to raise revenue, there are smarter, fairer ways to do it.”

Meanwhile, conservative and centrist critics accused Johnson of using populist rhetoric to mask fiscal mismanagement.

“This is classic Chicago politics,” said State Rep. Tom Demmer (R–Dixon). “When budgets fail, they reach for the nearest taxpayer. The problem isn’t that businesses aren’t paying enough — it’s that City Hall keeps spending too much.”

An Economy Already on Edge

Chicago’s economy has struggled to regain momentum following years of population decline, rising crime, and business relocations.

Major corporations including Caterpillar, Citadel, and Boeing have all moved their headquarters out of Illinois since 2022, citing “unfriendly business environments” and “regulatory uncertainty.”

Now, analysts fear Johnson’s proposal could accelerate the trend.

“The optics are terrible,” said urban economist Dr. Maria Santos of DePaul University. “At a time when Chicago should be courting employers and restoring confidence, this sends the opposite signal. It’s essentially saying: if you create jobs here, we’ll penalize you.”

Property developers and investors also voiced concern that new taxes on employers could further weaken the city’s already fragile commercial real estate market, as companies downsize or shift operations to suburban areas.

What Comes Next

The proposal is expected to face intense debate in the City Council over the coming weeks.

To pass, Johnson will need majority support — a tall order given the fierce opposition from business groups and several key aldermen.

If approved, the “head tax” would take effect January 1, 2026, applying to any business with 100 or more full-time employees working within city limits.

Critics are already preparing legal challenges, arguing that the measure could violate state commerce laws and discourage hiring, particularly among companies with seasonal or contract-based labor.

Political analysts say the controversy could define Johnson’s administration — and his legacy.

“Brandon Johnson came into office promising progressive reform,” said political analyst Robert Lasky. “But this fight over the head tax will determine whether he’s remembered as a visionary or as the mayor who drove jobs out of Chicago.”

Public Reaction: Anger, Confusion, and Fear

On social media, the response has been swift and polarized.

Supporters hailed the tax as a “bold step toward corporate accountability,” while opponents dubbed it #TheJobKillerTax and warned of layoffs and relocations.

“I just started hiring again after the pandemic,” wrote one local restaurant owner on X (formerly Twitter). “Now the city wants to charge me for giving people jobs? This is madness.”

Meanwhile, city workers and union leaders expressed cautious optimism, hoping that the new revenue could protect public sector jobs and pensions.

Still, most Chicagoans seem uncertain — and anxious — about what comes next.

A City at a Crossroads

As the debate unfolds, one thing is clear: Chicago stands at a crossroads between economic growth and fiscal desperation.

Whether Johnson’s “head tax” becomes a symbol of fairness or a warning of overreach will depend on how the city’s leaders — and its employers — respond in the weeks ahead.

“This isn’t just about numbers,” said Dr. Santos. “It’s about whether people believe Chicago is still a place worth building in — or a place to leave behind.”

For now, the nation is watching.

News

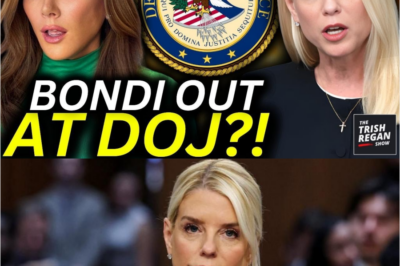

🚨 BREAKING: Pam Bondi reportedly faces ouster at the DOJ amid a fresh debacle highlighting alleged incompetence and mismanagement. As media and insiders dissect the fallout, questions swirl about accountability, political consequences, and who might replace her—while critics claim this marks a turning point in ongoing institutional controversies.

DOJ Missteps, Government Waste, and the Holiday Spirit Welcome to the big show, everyone. I’m Trish Regan, and first, let…

🚨 FIERY HEARING: Jasmine Crockett reportedly dominates a Louisiana racist opponent during a tense public hearing, delivering sharp rebuttals and sparking nationwide attention. Social media erupts as supporters cheer, critics react, and insiders debate the political and cultural impact, leaving many questioning how this showdown will shape her rising influence.

Protecting Individual Rights and Promoting Equality: A Congressional Debate In a recent session at Congress, members from both sides of…

🚨 ON-AIR DISASTER: “The View” hosts reportedly booed off the street after controversial prison comments backfired, sparking public outrage and media frenzy. Ratings reportedly plunge further as social media erupts, insiders scramble to contain the fallout, and critics question whether the show can recover from this unprecedented backlash.

ABC’s The View continues to struggle with declining ratings, and much of the blame is being placed on hosts Sunny…

🚨 LIVE COLLAPSE: Mrvan’s question, “Where did the data go?”, reportedly exposed Patel’s “100% confident” claim as false just 47 seconds later, sparking an intense on-air meltdown. Critics and insiders question credibility, accountability, and transparency, as the incident sends shockwaves through politics and media circles alike.

On March 18, 2025, during a House Judiciary Committee hearing, Congressman Frank Mirvan exposed a major FBI data security breach….

🚨 LIVE SHOCKER: Hillary Clinton reportedly reels as Megyn Kelly and Tulsi Gabbard call her out on live television, sparking a viral political confrontation. With tensions high, viewers are debating the fallout, insiders weigh in, and questions arise about Clinton’s response and the potential impact on her legacy.

This segment explores claims that the Russia investigation was allegedly linked to actions by the Hillary Clinton campaign during the…

🚨 MUST-SEE CLASH: Jasmine Crockett reportedly fires back at Nancy Mace following an alleged physical threat, igniting a heated public showdown. Social media explodes as supporters rally, critics debate, and insiders warn this confrontation could have major political and personal repercussions for both parties involved.

I’m joined today by Congresswoman Jasmine Crockett to discuss a recent clash with Republican Congresswoman Nancy Mace during the latest…

End of content

No more pages to load