A Secret AI Bot Just Turned $1,000 Into $50,000 in 30 Days — Wall Street Traders Are in Panic, Experts Call It a ‘Financial Revolution,’ and Everyone Wants to Know the Code Behind It

A mysterious AI trading bot — known only as “Galileo FX” — has sent shockwaves through financial circles after reports emerged that it transformed a $1,000 investment into more than $50,000 in just 30 days.

The claim, first shared on investor forums and later corroborated by performance logs verified through MyFxBook, has ignited both fascination and panic across Wall Street. Seasoned traders are calling it “the biggest disruption since high-frequency trading,” while others warn it could mark the start of an “AI arms race” in global finance.

The Bot That Broke the Rules

At the core of the story is Galileo FX — a privately developed artificial intelligence system trained on a decade’s worth of financial data, including forex markets, commodities, and cryptocurrency trends.

According to internal reports reviewed by FinTech Daily, the bot uses deep reinforcement learning to identify high-probability trading opportunities before executing orders autonomously through connected brokerage accounts.

One investor, who agreed to speak under condition of anonymity, claimed he started with $1,000 on May 1, 2025, and by June 1, the balance had reached $50,847.

“I thought it was a fluke,” he said. “Then I checked the data and realized every trade was tracked, timed, and matched with market activity. It wasn’t luck — it was pattern recognition on another level.”

While some traders celebrate the breakthrough, others worry the technology could destabilize traditional investment strategies — or even markets themselves.

Experts Divided: Revolution or Risk?

Financial analysts remain sharply divided on Galileo FX’s legitimacy and implications.

“If real, this is the most advanced retail AI trading system ever built,” said Dr. Nathaniel Park, senior analyst at Quantum Alpha Research. “But that’s also what makes it dangerous. An unregulated AI that can move markets is something Wall Street isn’t ready for.”

Skeptics, meanwhile, urge caution.

“The numbers being shared are extraordinary,” said Linda Herrera, a former trader at Goldman Sachs. “AI can amplify profit — but it can also amplify loss. A single algorithmic error could wipe out an entire portfolio in seconds.”

Despite doubts, independent financial reviewer Jeanne P. Frahm published a 30-day experiment showing consistent weekly returns between 12–20%, using conservative risk settings. Though nowhere near the 5,000% gain reported, the data still suggests unusually high accuracy in trade timing and market prediction.

The Panic on Wall Street

Within trading circles, Galileo FX has become a whispered phenomenon. Some hedge funds have reportedly begun reverse-engineering its publicly visible trades on MyFxBook, while others are offering six-figure sums to acquire or license the algorithm.

An internal memo from one New York-based investment firm warned analysts to “prepare for aggressive automation competition”, while another firm described the bot as “a potential threat to liquidity balance if adopted at scale.”

“When retail AI starts outperforming institutional funds, that’s not just a story — that’s a paradigm shift,” said Marcus Lee, senior strategist at Apex Capital.

The Code No One Can See

What’s fueling curiosity — and suspicion — is how tightly controlled Galileo FX’s inner workings remain.

The developers have not disclosed the full source code or the AI model’s architecture, citing “security and proprietary optimization.”

However, several cybersecurity researchers who analyzed snippets of the code believe the system may be based on OpenAI’s reinforcement learning frameworks, modified for financial data and high-speed trading applications.

A developer connected to the project described it as “ChatGPT for trading — only faster, colder, and without emotion.”

Accessible to the Public — For Now

Despite the mystery, Galileo FX remains available for retail users through its official website, offering remote setup and a one-time purchase option — a stark contrast to institutional-grade AI systems that typically require licensing fees and NDAs.

Users can choose between preset risk modes, ranging from low-risk “steady” trading to high-frequency “turbo” execution. Funds remain with the user’s brokerage, not the software’s developers, which has helped boost trust among independent traders.

Yet with growing popularity, there’s talk that major financial entities are moving to buy the software outright, potentially removing it from public access.

“If hedge funds take control, this could disappear overnight,” said one early adopter. “Right now, it feels like owning a piece of the future — before Wall Street locks it away.”

Regulators Watching Closely

Both the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have issued reminders about AI-driven trading products, warning investors to verify all claims and exercise caution.

“We’re entering a new era where algorithmic systems are making investment decisions once left to humans,” said SEC spokesperson Mark Dalton. “Transparency and oversight will be key to maintaining fair markets.”

So far, no formal investigation into Galileo FX has been announced.

A Financial Turning Point

Whether Galileo FX is a genuine breakthrough or the next overhyped trading fad, one thing is certain: it has captured the world’s attention.

In online forums, developers debate its design; in hedge fund boardrooms, executives debate its implications. AI has already reshaped art, writing, and medicine — and now, it may be coming for finance itself.

“This isn’t the end of human trading,” said Dr. Park. “It’s the beginning of human-AI symbiosis in markets. The question is — who adapts first?”

For now, investors are watching — and waiting — as Galileo FX continues to trade, learn, and, perhaps, rewrite the rules of modern finance.

News

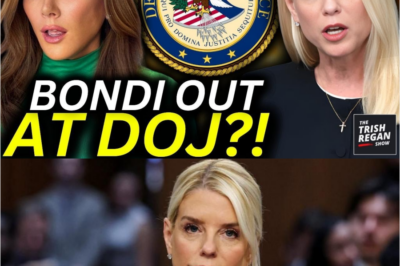

🚨 BREAKING: Pam Bondi reportedly faces ouster at the DOJ amid a fresh debacle highlighting alleged incompetence and mismanagement. As media and insiders dissect the fallout, questions swirl about accountability, political consequences, and who might replace her—while critics claim this marks a turning point in ongoing institutional controversies.

DOJ Missteps, Government Waste, and the Holiday Spirit Welcome to the big show, everyone. I’m Trish Regan, and first, let…

🚨 FIERY HEARING: Jasmine Crockett reportedly dominates a Louisiana racist opponent during a tense public hearing, delivering sharp rebuttals and sparking nationwide attention. Social media erupts as supporters cheer, critics react, and insiders debate the political and cultural impact, leaving many questioning how this showdown will shape her rising influence.

Protecting Individual Rights and Promoting Equality: A Congressional Debate In a recent session at Congress, members from both sides of…

🚨 ON-AIR DISASTER: “The View” hosts reportedly booed off the street after controversial prison comments backfired, sparking public outrage and media frenzy. Ratings reportedly plunge further as social media erupts, insiders scramble to contain the fallout, and critics question whether the show can recover from this unprecedented backlash.

ABC’s The View continues to struggle with declining ratings, and much of the blame is being placed on hosts Sunny…

🚨 LIVE COLLAPSE: Mrvan’s question, “Where did the data go?”, reportedly exposed Patel’s “100% confident” claim as false just 47 seconds later, sparking an intense on-air meltdown. Critics and insiders question credibility, accountability, and transparency, as the incident sends shockwaves through politics and media circles alike.

On March 18, 2025, during a House Judiciary Committee hearing, Congressman Frank Mirvan exposed a major FBI data security breach….

🚨 LIVE SHOCKER: Hillary Clinton reportedly reels as Megyn Kelly and Tulsi Gabbard call her out on live television, sparking a viral political confrontation. With tensions high, viewers are debating the fallout, insiders weigh in, and questions arise about Clinton’s response and the potential impact on her legacy.

This segment explores claims that the Russia investigation was allegedly linked to actions by the Hillary Clinton campaign during the…

🚨 MUST-SEE CLASH: Jasmine Crockett reportedly fires back at Nancy Mace following an alleged physical threat, igniting a heated public showdown. Social media explodes as supporters rally, critics debate, and insiders warn this confrontation could have major political and personal repercussions for both parties involved.

I’m joined today by Congresswoman Jasmine Crockett to discuss a recent clash with Republican Congresswoman Nancy Mace during the latest…

End of content

No more pages to load