The champagne flute slipped from my fingers, crystals shattering against the marble floor as my new daughter-in-law’s

words echoed through the Mitchell family estate. This is the family embarrassment we’re stuck with, Samantha had announced

to her wealthy parents with that practiced smile of hers, her manicured hand barely grazing my shoulder. The

entire wedding reception seemed to pause, 200 guests turning to stare at the 55year-old woman in the understated

navy dress. That’s when Robert Mitchell’s face went white as his tuxedo shirt. If you’re watching this,

subscribe and let me know where you’re watching from. Let me backtrack to how we got here because honey, this story is

about to get interesting. My name is Margaret Thompson, but most people call me Maggie. I’ve spent the last 15 years

perfecting the art of being strategically invisible, which turns out to be excellent training for what comes

next. My son David had been dating Samantha for 8 months, and I’d met her exactly twice before today, two brief

dinners where she’d asked pointed questions about my modest lifestyle and whether I might need assistance with

expenses as you get older. The wedding itself was spectacular. I’ll give them that. The Mitchell estate sprawled

across 50 acres of perfectly manicured Connecticut countryside, complete with a chapel that could seat 300 gardens that

must have cost a fortune. Samantha floated down the aisle in a dress that probably cost more than most people make

in months. And David looked happier than I’d seen him since his father died. I’d chosen my outfit carefully. A navy blue

dress from a nice department store paired with my grandmother’s pearl necklace. Nothing flashy, nothing that

would draw attention. I’d learned long ago that the key to maintaining certain privacy was to look exactly like what

people expected to see. a widow living comfortably but modestly on her late husband’s engineering pension and life

insurance. The ceremony was beautiful, even if I did notice Samantha’s mother, Patricia, sizing me up like I was

something that didn’t quite belong. The reception was where things got interesting. The Mitchell family had

spared no expense, with ice sculptures, a 12-piece orchestra, and enough flowers

to open their own shop. I’d found a corner table watching my 32-year-old son

dance with his new wife when Samantha approached with her parents in tow. “Mom and dad,” she’d said with that

sugarsweet tone that made my teeth ache. “I want you to meet David’s mother.”

Then came the words that changed everything. Robert Mitchell’s champagne flute had frozen halfway to his lips,

his eyes locked on my face with an expression of dawning recognition that made my stomach flip. Margaret

Thompson,” he whispered. And suddenly, I wasn’t invisible anymore. “Wait, aren’t

you the woman from the Mitchell Holdings acquisition meeting 3 years ago? Aren’t you that mysterious investor who bought

my company?” Robert Mitchell’s words cut through the reception noise like a knife through silk. The color drained from

Samantha’s face as she looked between her father and me, confusion replacing her earlier smuggness. Patricia

Mitchell’s diamond bracelet caught the chandelier light as her hand flew to her throat, and I could practically hear the

gears turning in her socialite brain. The truth is, most people don’t know what real wealth looks like. They expect

diamonds and designer labels, flashy cars, and obvious displays. What they

don’t expect is a woman in a simple but elegant dress who shops at normal stores

and drives a reliable sedan. That’s exactly what I’ve been counting on for the past 15 years. It started with my

late husband Tom’s invention, a small piece of technology that revolutionized smartphone battery efficiency. We were

both engineers, Tom and I, working for a tech company in Silicon Valley back in the early 2000s. When Tom developed his

power management system in 2010, we thought maybe we’d make enough to retire comfortably. We had no idea we were

sitting on a gold mine. The patent sold for $22 million in 2012. 22 million.

David was 24 then, fresh out of graduate school with his marketing degree and full of dreams about building his own

career. Tom and I made a decision that day that would shape the next 13 years of our lives. We told David we’d gotten

a substantial settlement, enough to be very comfortable, but nothing extravagant. He never questioned it,

probably assumed it was a few million at most. What David didn’t know was that 22

million was just the beginning. Tom and I took that money and started investing systematically. Conservative blue chip

stocks at first, then growth companies as we learned the market, real estate in emerging areas, tech startups with solid

fundamentals. Tom had a gift for spotting undervalued opportunities before the market caught on. By the time

he died 5 years ago in 2020, our portfolio was worth over $800 million.

800 million, the same amount I’d later used to acquire Mitchell Holdings 2 years after Tom’s death. The irony was

delicious. While Samantha had been giving me concerned looks and asking if I needed help managing my finances as I

got older, I’d been the anonymous investor who’d rescued her father’s failing company, the same company he’d

nearly destroyed through overexpansion and poor debt management, forcing him to accept a buyout from what he thought was

a corporate investment firm. That investment firm was a shell company controlled by me. I’d bought Mitchell

Holdings not out of malice, but because it was fundamentally sound beneath Robert’s mismanagement. The company had

good bones, solid customer relationships, and talented employees under proper financial oversight. It was

thriving again. The man who’d just been called a family embarrassment had been living off my business decisions for the

past 3 years. I’m sorry, I said quietly, looking directly at Robert. I think you

have me confused with someone else, but we both knew he didn’t. I could see the recognition in his eyes, the memory of

that boardroom meeting where I’d sat quietly while my attorneys handled the negotiations. He’d barely acknowledged

me then, assuming I was just someone’s wife along for the formalities. Now, as

Samantha stared at us both with growing alarm, I realized my carefully maintained discretion was about to

become very complicated. The next morning, I sat in my comfortable apartment, sipping coffee from my

favorite mug, watching David pace across my living room like a caged animal. He’d called at 7 a.m., demanding answers to

questions I wasn’t ready to address. Sleep had been impossible after the reception. My mind replaying Robert

Mitchell’s recognition and the panic I’d seen flash across Samantha’s eyes. “Mom,

you have to help me understand what happened last night,” David said, running his hands through his hair the

same way he had as a frustrated child. Robert Mitchell pulled me aside after you left and asked some very pointed

questions about Dad’s patents and your investment activities. I’d slipped out quietly after Robert’s revelation,

claiming exhaustion. The truth was, I needed time to think. 15 years of

carefully maintained privacy had cracked in a single moment, and I wasn’t sure how to handle the exposure. David had

inherited his father’s intensity, but channeled it differently. Where Tom had been methodical and strategic, David was

direct and emotional. “What kind of questions?” I asked, though I had a good idea. He wanted to know about Dad’s

technology patents. about whether you’d been involved in any major business transactions, about our family’s actual

financial situation. David stopped pacing and fixed me with those serious brown eyes he’d inherited from Tom. Mom,

he seemed to think you were some kind of major investor. It was bizarre. The coffee tasted bitter suddenly. This was

the conversation I’d been both expecting and dreading. David had built his career

as a senior marketing manager through genuine talent and hard work. He’d earned his position at a respected firm,

bought his house through careful saving, and lived within his means because he believed those were the values Tom and I

had taught him. How could I explain that while he’d been working 60-hour weeks to earn his promotions, I could have bought

his entire company without straining my budget, while he’d been saving diligently for his house down payment,

I’d been managing a portfolio worth more than most small towns. “David, sit

down,” I said gently. We need to talk. But before I could continue, my phone

buzzed with a text message from Samantha. Margaret, I think we should have lunch today. There are some things

David and I would like to discuss with you. I showed David the message, watching his expression shift from

confusion to concern. What do you think she wants to discuss? I had a pretty

good idea. Samantha Mitchell wasn’t the type to let mysteries remain unsolved, especially when they potentially

involved money. She’d probably spent the entire night questioning her father about his suspicions, and now she was

ready to investigate further. The question was, how much had Robert actually figured out from that brief

boardroom encounter 3 years ago? I think, I said carefully, your wife is

more observant than we’ve given her credit for. David’s phone rang, Samantha’s name appearing on the screen.

He answered immediately and I could hear her voice even from across the room. Bright and artificially cheerful. David,

honey, I was hoping we could all have lunch together today. There are some family things I’d love to discuss with

your mother now that we’re officially relatives. When he hung up, David looked at me with the same expression he’d worn

as a teenager when he suspected I knew more about his broken curfew than I was letting on. Mom, is there something you

need to tell me about our family’s finances? Outside my apartment window, I watched the familiar rhythm of morning

commuters heading to work. People with straightforward concerns about deadlines and meetings. I envy them their

simplicity, their ordinary worries that seemed luxurious compared to mine. Everything, I said finally. I need to

tell you everything. Samantha arrived at the restaurant 45 minutes early, already

seated at a corner table when David and I walked in. She’d chosen the most expensive place in town, I noticed, and

had taken the seat that gave her the best view of the entire room. Her perfectly styled blonde hair caught the

afternoon sunlight, and she was wearing a designer suit I recognized from a magazine spread I’d seen recently.

“Margaret, David, thank you so much for meeting me,” she said, standing to embrace us both. Her smile was radiant,

but I caught the calculating look in her green eyes as she assessed my simple black dress and modest jewelry. I

ordered us a nice bottle of wine to celebrate being family. The wine was a Bordeaux that cost more than most people

spent on groceries in a month. Clearly, Samantha was making a statement about her expectations for this conversation.

This is lovely, dear, I said, settling into my chair, though perhaps a bit extravagant for a casual family lunch.

“Oh, I don’t think anything about our family is casual anymore,” she replied,

her smile never wavering. I spent some time last night talking with Daddy about his business experiences, and he shared

some fascinating stories about corporate acquisitions and anonymous investors. David looked between us, clearly sensing

undercurrens he didn’t understand. Samantha, what does this have to do with lunch? She ignored him, focusing

entirely on me. You know, Margaret, I majored in business at Wharton. I find corporate finance absolutely

fascinating, especially complex investment structures and shell companies. Daddy mentioned that when

Mitchell Holdings was acquired, the buyer was remarkably discreet. I sipped

my wine and waited. Let her make the first real move. The interesting thing about discreet investors, she continued,

is that they often have very good reasons for maintaining their privacy, usually involving substantial wealth

that they prefer to keep out of public attention. That sounds reasonable, I said calmly. Samantha leaned forward

slightly, her voice taking on the tone of someone sharing a delicious secret. Daddy said the woman in the acquisition

meeting was quiet, elegant, and seemed to defer to her attorneys, but he

remembered thinking at the time that she had the bearing of someone accustomed to making significant decisions. David was

staring at me now, pieces beginning to fall into place in his mind. Mom. Before

I could respond, Samantha pulled out her phone and showed us a photograph. It was a news article from three years ago

about the Mitchell Holdings acquisition, including a small photo from the signing ceremony. There, partially obscured by

lawyers and corporate executives, was a woman in a navy blue dress whose face was barely visible. The photo quality

isn’t great, Samantha said conversationally. But the woman’s posture, her height, even the way she

holds her purse, it’s remarkably similar to yours, Margaret. The silence stretched between us as David studied

the photo, recognition dawning in his expression. I had to admire Samantha’s thoroughess, even as I felt my carefully

constructed privacy beginning to unravel. That’s quite a coincidence, I said finally. Isn’t it? Samantha’s smile

had a sharp edge now. Of course, coincidences happen all the time, like how my family’s financial difficulties

began right around the time someone paid $800 million for Daddy’s company, or how

that same mysterious investor seemed to vanish completely after the acquisition, almost like they preferred to remain

anonymous. David set down his wine glass with shaking hands. Mom, please tell me

you’re not who she thinks you are. I looked at my son, at the young man I’d raised to value honesty and integrity

above all else, and realized that 15 years of well-intentioned deception had

finally caught up with me. David, there are some things about your father’s patents and our investments that I never

explained to you. Samantha’s triumph was evident in every line of her perfectly composed face. But as I watched her

savor what she clearly thought was her moment of victory, I found myself wondering if she had any idea what she’d

just unleashed. 3 days later, I sat in my financial advisor’s downtown office,

watching James Harrison review the documents I’d requested. The lunch with David and Samantha had ended with my son

storming out after I’d confirmed his worst suspicions, and his new wife making veiled suggestions about family

financial planning and shared responsibilities. Now I needed to understand exactly what position I was

in. Margaret, I have to say this is an unusual request, James said, adjusting

his wire rimmed glasses as he studied the Mitchell family financial profile spread across his mahogany desk. Why the

sudden interest in your daughter-in-law’s family background? I’d called James the morning after our

disastrous lunch, asking for a comprehensive analysis of the Mitchell family’s current financial situation.

What I’d learned was more complex than I’d expected, because I didn’t realize when I bought Mitchell Holdings that I

was acquiring my future daughter-in-law’s inheritance. James’ eyebrows shot up. Your daughter-in-law?

The one who just married David? When I nodded, he let out a low whistle. That’s

complicated. Tell me something I don’t know. He pulled up several files on his computer, cross-referencing data I’d

requested. All right, let’s walk through this chronologically. In 2021, Mitchell

Holdings was struggling with debt service on expansion loans they’d taken in 2019. Robert Mitchell had

overextended the company, buying smaller competitors, and when the economy tightened, they couldn’t service the

debt load. I remembered that acquisition well. It had been one of my more strategic investments, buying a

fundamentally sound company at a discount because of temporary financial stress. What was the family’s

expectation at that time? According to the financial records we’ve obtained, Samantha Mitchell had been positioning

herself as the eventual successor to her father. She’d worked there summers during college, completed her MBA with a

focus on family business management, and had been telling people she’d be taking over the company after a transition

period. The pieces were fitting together in an uncomfortable way. So, when I acquired the company and brought in

professional management, I eliminated her expected career path. More than that, you eliminated what she saw as her

birthright. James pulled up another document. Here’s where it gets interesting. I’ve been monitoring some

discreet inquiries about your investment activities. Someone has been asking questions about shell companies,

acquisition structures, and anonymous investors. My stomach tightened. What

kind of questions? Professional level questions. not casual curiosity, but the

kind of research that suggests someone with business training and possibly legal connections. He turned his monitor

toward me. Margaret, I think your daughter-in-law has hired a private investigator. The implications hit me

immediately. 15 years of careful legal structures and deliberate discretion

could be unraveled by someone with sufficient motivation and resources. How vulnerable are we? That depends on how

deep they’re willing to dig and what they plan to do with the information. James’s expression was serious. Your

privacy protections are solid, but they’re not impenetrable. A determined investigation with legal backing could

eventually trace the ownership structures back to you. I thought about Samantha’s behavior at lunch. The way

she’d presented her discoveries like a chess player revealing a winning strategy. What would you recommend?

Honestly, get ahead of this. If she’s building a case for some kind of financial claim or family obligation,

it’s better to control the narrative than to be exposed by it. He leaned back in his chair, considering, “But

Margaret, there’s something else you need to think about. If this becomes public, it won’t just affect you.

David’s career could be impacted if it looks like his success was connected to family wealth he wasn’t even aware of.”

I hadn’t fully considered that angle. David’s reputation in the marketing world was built on merit. If it came out

that his mother was a major investor, people might question every promotion he’d earned, every client relationship

he’d built. The irony was bitter. I’d hidden my wealth to protect him. And now

that secret might damage everything he’d worked to achieve. There’s one more thing, James continued, pulling up a

final document. The Mitchell family’s current financial situation is more precarious than it appears. They’ve been

maintaining their lifestyle through credit and loans, probably expecting Robert to find another business

opportunity or for Samantha to marry into wealth. And now she thinks she has.

Exactly. But Margaret, if they’re planning some kind of approach for financial assistance or inclusion in

your investments, you need to be prepared for what that might look like. This isn’t going to be a simple family

conversation anymore. As I left James’s office, I realized I was facing the same

decision Tom and I had made 15 years ago. Except now the stakes were much higher. This time, I wouldn’t just be

protecting my son’s independence. I’d be fighting to prevent everything I’d built from being turned against my family.

That evening, I did something I hadn’t done in months. I opened a bottle of the good wine Tom and I had been saving for

special occasions, poured myself a generous glass, and spread 15 years of financial records across my dining

table. If Samantha wanted to play investigator, she was about to discover she’d chosen the wrong person to

underestimate. The numbers told a story of patience and strategy that I’d almost forgotten. Tom and I hadn’t just gotten

lucky with his patent sale. We’d been methodical, researching every investment, diversifying carefully, and

reinvesting profits into emerging opportunities. That initial 22 million had grown to 50 million by 2015, then to

200 million by 2018. By the time Tom died, we were worth over 800 million,

and I’d continued growing it steadily. More importantly, I’d been quietly building something larger than just

wealth. I owned significant stakes in 12 different companies, held licensing agreements on 17 different technologies,

and had investments in everything from renewable energy to biotechnology. I wasn’t just wealthy. I was connected to

innovation in ways that even James didn’t fully understand. My phone buzzed with a text from David. Mom, Samantha

and I would like to come over tomorrow evening. She has some ideas about how our family should handle this new

information. I almost laughed. Samantha had ideas, did she? I could imagine what

those ideas might include. Probably something involving trust funds and family meetings in a more collaborative

approach to financial decisionmaking. What she didn’t understand yet was that I’d been managing expectations and

protecting my interests longer than she’d been working in business. I pulled up the legal documents James had

provided about the Mitchell family’s finances. Their situation was more fragile than I’d initially realized. The

family estate was mortgaged at 80% of its current value. Their investment accounts had been systematically

depleted to maintain their lifestyle, and they had significant credit obligations tied to Robert’s assumption

that he’d eventually monetize his business relationships. Robert Mitchell thought he’d retired comfortably on the

proceeds from selling his company. But the reality was more complex. Much of his retirement income came from

consulting fees and board positions I’d arranged through Mitchell Holdings new management. His comfortable lifestyle

was more dependent on my continued ownership than he realized. But that was just the surface. I opened my laptop and

began researching the specifics of Samantha’s recent activities. If she’d hired a private investigator, there

would be traces, financial records, communication patterns, changes in her daily routine that suggested she was

building a case for something. What I found was fascinating and concerning. Samantha had indeed hired a private

investigation firm specializing in corporate asset tracing. She’d also been in contact with an attorney who

specialized in family wealth disputes. Most telling, she’d opened several new credit accounts in the past month,

probably financing her investigation with the expectation that it would pay off substantially. She hadn’t married my

son for love. She’d married him as an investment strategy. The wine was making me philosophical, or maybe just honest

with myself for the first time in years. I’d spent 15 years being the discreet

widow, content to let people assume I was living comfortably but modestly while I quietly built something

substantial. But Samantha’s little performance at the wedding reception had changed something fundamental. I was

tired of being underestimated, more than tired. I was done. Tomorrow, when David

brought his wife to discuss her ideas for our family’s financial future, I was going to give them both an education in

exactly who they decided to investigate. Because Margaret Thompson, the careful investor, was about to become Margaret

Thompson, the strategic opponent, and I had 15 years of experience in winning

games that other people didn’t even know they were playing. David arrived at my apartment the next evening with

Samantha, both carrying themselves like diplomats approaching a delicate negotiation. I’d prepared for their

visit carefully, setting out a simple cheese and fruit plate and opening a moderately priced bottle of wine.

Nothing that would suggest the resources I actually had available. “Mom, thank you for agreeing to sit down with us,”

David began, his voice carrying the careful tone of someone walking through a minefield. I know the last few days

have been complicated. Samantha had dressed for the occasion in a conservative business suit. Her MBA

training evident in the portfolio she carried and the way she’d arranged herself in my chair. Margaret, I want to

start by saying that everything we discussed tonight stays within the family. We’re all on the same side here.

I almost smiled at her presumption. Of course, dear. What did you want to discuss? She opened her portfolio,

revealing several documents she’d obviously prepared with care. Well, I’ve been thinking about our conversation at

lunch, and I realize we may have gotten off on the wrong foot. What I’d like to propose is a more collaborative approach

to family financial planning. Collaborative how? David shifted uncomfortably beside her, clearly

uncertain about the direction this was heading. Samantha has some ideas about how we might structure things to benefit

everyone involved. The thing is, Margaret, Samantha continued, her voice

taking on the confident tone of someone presenting a business proposal. Family wealth works best when it’s managed

strategically across generations. David and I have been discussing how we might create a structure that protects your

privacy while providing more transparency for family planning. There it was, the real purpose of this

meeting. I sipped my wine and waited for her to continue. We were thinking about establishing a family foundation,

something that would allow us to make charitable contributions while also providing some tax advantages and

investment coordination. She pulled out what looked like a preliminary legal document. I’ve had some initial

conversations with an attorney who specializes in family wealth management. The audacity was breathtaking. She’d

discovered I had money and immediately begun planning how to access it, complete with legal consultation and

formal proposals. That sounds very thorough. The foundation would be controlled by a board of family

trustees, she continued enthusiastically. You, me, David, eventually any children we might have.

It would give us all input into major financial decisions while maintaining appropriate oversight. David was staring

at the documents she’d produced, looking overwhelmed. “Samantha, maybe we should

slow down here. This is a lot to process.” “Actually, David, I think your wife has put considerable thought into

this proposal,” I said calmly. “Tell me, Samantha, what kind of initial funding

were you envisioning for this foundation?” Her eyes lit up at what she interpreted as interest. “Well, that

would depend on the scope of the charitable activities we wanted to pursue. I was thinking maybe we’d start

with something substantial enough to make a real impact. Perhaps 50 or 60 million to establish credibility in the

philanthropic community. 50 or 60 million as a starting point from a woman

who’d called me a family embarrassment less than a week ago. And the board structure you mentioned, I continued

conversationally. How would voting rights be allocated? I think equal representation makes the most sense, she

replied confidently. Three trustees, three votes, very democratic. I set down

my wine glass and looked directly at her. Samantha, can I ask you something honestly? Of course. Do you love my son?

The question clearly caught her off guard. She glanced at David, then back at me. That’s what kind of question is

that? A simple one. Do you love David for who he is, or do you love what you

think being married to him might provide you? The silence in the room was electric. David was looking between us

with growing alarm, and Samantha’s composed facade was beginning to crack. “I think that’s an unfair

characterization of our relationship,” she said finally. “Is it?” I stood up and walked to my bookshelf, pulling out

a folder I’d prepared. “Because I have some information that might help clarify things.” I returned to my seat and

opened the folder, revealing the investigation report James had prepared on Samantha’s recent activities. Her

face went pale as she recognized some of the documents. This is a record of your communications with Asheford private

investigations over the past 2 weeks, I said calmly. Apparently, you hired them

to research corporate ownership structures and trace anonymous investors. Quite expensive from what I

can see. David stared at his wife with growing disbelief. Samantha, you hired private investigators. It’s not what it

sounds like, she said quickly. I was just trying to understand our family’s financial situation better. You were

building a case. I corrected. These records show you also consulted with Harrison Webb and Associates, a law firm

specializing in family wealth disputes and trust challenges. I pulled out another document. This is interesting.

You opened three new credit accounts in the past month, borrowing against your expected family financial improvements.

That’s quite an assumption to make. Samantha was scrambling now. her careful composure completely gone. Margaret, you

have to understand. I was just trying to protect our family’s interests. If there are substantial assets involved, we need

to plan appropriately. Whose interests exactly? I asked. Because according to this financial profile, James prepared,

“Your family situation is considerably more precarious than you’ve been letting on.” I spread several more documents

across the coffee table. Your parents estate is mortgaged at nearly 80% of value. Their investment accounts have

been depleted to maintain their lifestyle since your father lost Mitchell Holdings. Most of their current

income actually comes from consulting arrangements I’ve maintained through the company’s new management. David was

reading over the documents, his face cycling through confusion, anger, and something that looked like heartbreak.

Mom, how do you know all this? Because David, when someone tries to investigate

me, I investigate them back. And what I found is that your wife’s family has

been living on borrowed time and borrowed money for the past three years. Samantha found her voice, but it was

shaky now. That doesn’t change the fact that we’re family now, that we should be working together instead of against each

other. You’re absolutely right, I said, standing up and walking to my window. We

should be working together. The question is, what kind of work did you have in mind? I turned back to face them both.

Because here’s what I think happened. You discovered that I have money. And you immediately began planning how to

access it. Not how to contribute to it, not how to help manage it, but how to

restructure it so you’d have control over spending decisions. That’s not fair, Samantha protested. Isn’t it? I

pulled out one more document from my folder. This is a recording of a phone conversation you had with your college

roommate 3 weeks before you met David. In it, you specifically mention that you’re tired of dating men who can’t

provide financial security and that you’re looking for someone from a stable family with good long-term prospects.

The silence that followed was absolute. David was staring at his wife like he’d never seen her before. And Samantha

looked like she was calculating how quickly she could retreat from this conversation. David, I said gently, I

think you need to ask yourself whether the woman you married is the person you thought she was. But even as I said it,

I realized that this confrontation was just the beginning. Samantha Mitchell wasn’t the type to give up easily, and

I’d just shown her exactly how much was at stake. If she’d been strategic before, she was about to become

dangerous. What happens now? David asked quietly. I looked at my son, at the man

I’d raised to value honesty and hard work, and made a decision that would change all our lives. Now we find out

what everyone is really made of. The next two weeks passed in careful silence. David moved back to his

apartment temporarily, telling me he needed time to process everything and

figure out what’s real anymore. Samantha had stormed out of my apartment that night, but not before making it clear

that she considered our conversation a declaration of war. She proved to be more dangerous than I’d anticipated. The

first sign of trouble came when James Harrison called me on a Friday morning, his voice tight with concern. Margaret,

we have a problem. Someone has been making inquiries with the SEC about your investment structures. Professional

inquiries suggesting they’re building a case for some kind of regulatory violation. I felt my stomach drop. What

kind of violations? Failure to properly disclose beneficial ownership in publicly traded companies. potential

insider trading around some of your acquisitions. Questions about whether your shell companies properly reported

their activities. He paused. Margaret, this isn’t casual curiosity anymore.

Someone is trying to build a legal case against you. I knew exactly who that someone was. How serious is this? It

depends on what they find and what they intend to do with it. Your structures are legal, but complex financial

arrangements can sometimes look suspicious to regulators who don’t understand the full context. If they

file a formal complaint, you could be looking at months or years of investigation, even if you’re ultimately

cleared. The implications were staggering. Not just the legal costs and time, but the publicity that would

destroy the privacy I’d maintained for 15 years. What would you recommend? Honestly, end this before it gets worse.

Whatever family dispute triggered this investigation needs to be resolved quickly because regulatory scrutiny has

a way of expanding beyond the original complaint. I hung up and sat in my apartment thinking through my options.

Samantha had escalated from private investigation to potential legal warfare, probably hoping to force me

into a settlement rather than risk public exposure. It was actually a clever strategy, if morally

questionable. My phone rang. David’s name appeared on the screen. Mom, we

need to talk. Something’s happened. He arrived an hour later, looking haggarded and older than his 32 years. Samantha’s

filed for separation, he said without preamble. Her lawyer says she’s concerned about potential financial

liabilities from undisclosed family assets. I almost admired her thoroughess. By filing for separation,

she was protecting herself legally while positioning for a potential divorce settlement. I’m sorry, David. Are you?

He looked at me with eyes that held more pain than anger because it feels like you orchestrated this whole thing. Like

you wanted my marriage to fall apart so you could prove some point about her motivations. The accusation hit harder

than I’d expected. David, I never wanted your marriage to fail. I wanted you to

understand who you’d married before it was too late to make an informed choice. by destroying her family’s financial

security, by investigating her like she was a criminal. He shook his head. Mom,

I don’t even know who you are anymore. That hurt, but I pushed through it. I’m

the same person who raised you to value honesty and integrity. The same person who wanted you to succeed on your own

merits rather than family money. And look how that turned out, he said bitterly. My wife is leaving me. Her

family’s financial situation is collapsing. And now I find out my mother is some kind of corporate mogul who’s

been lying to me for 15 years. I wanted to reach for him to comfort him the way I had when he was a child with a scraped

knee or a broken toy. But the distance between us felt unbridgegable. David,

there’s something else you need to know. Samantha has filed complaints with federal regulators about my investment

activities. She’s trying to force me into a public legal battle. He stared at me. What does that mean? It means this

isn’t over. It’s just beginning. And I need you to decide whether you’re going to stand with me or let her destroy

everything I’ve built to protect our family. The silence stretched between us. Finally, David looked up at me with

something that might have been the beginning of understanding. What do you need me to do? The meeting took place in

James Harrison’s conference room the following Monday. Present were myself, David, Samantha, her attorney, Marcus

Webb, and her parents, Robert and Patricia Mitchell. The atmosphere was tense enough to cut with a knife. “Let’s

be clear about why we’re here,” Marcus Webb began, adjusting his expensive suit as he spread documents across the

mahogany table. “My client has discovered that Mrs. Thompson has been concealing substantial assets while

allowing her son’s wife’s family to experience financial hardship. This suggests either a deliberate pattern of

deception or potential financial impropriy that warrants investigation.

James Harrison sitting beside me responded calmly. Mr. Web, Mrs.

Thompson’s financial activities are completely legal and properly reported. Your client’s recent regulatory

complaints appear to be motivated by personal grievances rather than legitimate concerns. Samantha leaned

forward, her voice carefully controlled. This isn’t about personal grievances.

This is about family responsibility and transparency. Margaret has been manipulating people’s lives while

pretending to be something she’s not. I finally spoke. Samantha, I’ve never

manipulated anyone. I invested in underperforming companies and improved them. I maintained my privacy because I

preferred discretion to publicity. Neither of those things is illegal or immoral. You bought my father’s company

and let him think he’d failed as a businessman, she shot back. Your father did fail as a businessman, I replied

evenly. I saved his company and protected his employees jobs. Under his management, Mitchell Holdings would have

been bankrupt within months. Robert Mitchell, who’d been silent until now, cleared his throat. Mrs. Thompson, I

appreciate what you did for the company, but you can’t deny that you’ve been strategic about concealing your

involvement in our family’s affairs. Strategic, yes. Deceptive, no. You never

asked about my investment activities, and I had no obligation to volunteer the information. Marcus Webb pulled out a

thick folder. Mrs. Thompson, we have evidence that you’ve used your financial position to manipulate multiple

situations involving my client’s family. the consulting fees paid to Mr. Mitchell, the timing of various business

decisions affecting their financial stability, even the investigation into my client’s personal activities.

Evidence of what exactly? James asked. Of a pattern of control and manipulation

designed to maintain power over this family’s financial future. I looked around the table at these people who

thought they understood the game they were playing. Mr. Web, let me make something very clear. I don’t control

your client’s family. I don’t owe them money. I don’t owe them explanations. And I certainly don’t owe them access to

my assets. But you do owe your son honesty, Samantha interjected. And you

owe your daughter-in-law basic respect. Respect? I felt something cold settle in

my chest. You introduced me as a family embarrassment at your wedding reception. You hired investigators to research my

private affairs. You filed regulatory complaints to try to force me into a financial settlement. and now you want

to lecture me about respect. The silence that followed was deafening. David, who’d been quiet throughout the meeting,

finally spoke. What do you want, Samantha? What would it take to end this? She exchanged glances with her

attorney, then looked directly at me. I want a formal family financial agreement, something that establishes

clear expectations and responsibilities for all parties. What kind of responsibilities? I asked. Marcus Webb

pulled out another document. We’re proposing a family trust structure with shared governance and defined

distribution policies. Mrs. Thompson would contribute a substantial portion of her assets to the trust, which would

be managed by a family board for the benefit of all members. I almost laughed at the audacity. You want me to put my

money into a trust controlled by a committee that includes people who’ve been investigating me and filing

complaints against me. We want a fair arrangement that protects everyone’s interests, Samantha said. I stood up and

walked to the conference room window, looking down at the city street where people were going about their normal lives, oblivious to the financial

warfare being conducted 20 floors above them. “I have a counter proposal,” I said finally. I turned back to face the

room. “Samantha, you have 72 hours to withdraw all regulatory complaints and

cease all investigation activities. In return, I’ll provide a settlement that allows you and your parents to maintain

your current lifestyle without further interference from me. What kind of settlement? Marcus Webb asked

suspiciously. $5 million, one-time payment. In exchange, you sign

agreements never to contact my son or me again. The room went completely silent.

David stared at me in shock. Mom, you can’t be serious. But I was completely

serious. I just offered to pay $5 million to remove toxic people from our

lives permanently. And judging by the expressions around the table, everyone was beginning to understand exactly how

serious I was about protecting what mattered to me. $5 million, Samantha

repeated slowly, as if testing how the words sounded. To never contact David again. That’s correct. Marcus Webb was

already calculating. I could see it in his eyes. 5 million was more than his

client could hope to win in any legal proceeding, and it came without years of litigation risk. Mrs. Thompson, that’s a

generous offer, but it seems designed to break up a marriage rather than resolve a family dispute. Mr. Web, the marriage

was already broken. I’m simply offering to pay for a clean ending rather than a messy one. David stood up abruptly. Mom,

stop. Both of you, just stop. He looked around the room with an expression of complete disgust. This is insane. We’re

sitting here negotiating the price of my marriage like it’s a business transaction. Isn’t that exactly what

it’s been? I asked gently. He turned to Samantha, his voice carrying a pain that

made my heart ache. Samantha, I need you to answer something honestly. Did you marry me because you loved me or because

you thought I came from money? The silence stretched for nearly a full minute. David, that’s not a fair

question,” she said finally. “It’s the only question that matters.” I watched my son’s face as he waited for an answer

that never came. In that silence, 15 years of careful parenting choices,

financial discretion, and protective secrecy crystallized into a single moment of clarity. “$5 million,” I

repeated, looking directly at Samantha. Plus, I arranged for your parents to keep their house and your father to

retain his consulting position at Mitchell Holdings. You sign the papers and walk away from my family. And if I

refuse, I smiled. And for the first time in this entire ordeal, it was completely

genuine. Then you get nothing. Your parents lose their house, your father loses his income, and you spend the next

several years in legal proceedings that will cost you far more than you could ever hope to win. Marcus Webb was

whispering urgently in Samantha’s ear, probably explaining the mathematical reality of the situation. 5 million in

hand versus years of expensive litigation with an uncertain outcome. I need time to consider this, Samantha

said. You have until noon tomorrow. After that, the offer expires and you

deal with the consequences of the complaints you filed. As the meeting broke up, David lingered behind while

the others filed out. Mom, did you really just buy my freedom from my wife? No, sweetheart. I just gave you the

information you needed to make your own choice. He was quiet for a long moment. What if she takes the money? Then you’ll

know exactly who she was, and you can move forward with your life. And if she doesn’t, then you’ll still know who she

was, and I’ll make sure she regrets trying to manipulate our family. David looked at me with something that might

have been admiration mixed with fear. When did you become so ruthless? I thought about the question seriously. I

think I always was, David. I just never had a reason to show it before. The next morning at 11:47 a.m., Marcus Webb

called James Harrison to accept the settlement offer. By 5:00 p.m., the papers were signed and the money

transferred. Samantha took the $5 million and disappeared from our lives as completely as if she’d never existed.

David filed for divorce the following week, citing irreconcilable differences.

6 months later, he called me on a Sunday evening. Mom, I met someone. Her name is

Sarah. She’s a teacher and she has no idea you’re wealthy. How do you know? Because when I told her my mother lived

in a nice apartment and drove a reliable car, she said that sounded like the kind of woman who had her priorities

straight. I smiled, feeling something relaxed in my chest that had been tense for years. She sounds perfect. When do I

get to meet her? Next Sunday. But mom, when we have dinner, can you just be the woman who raised me to work hard and

treat people with respect? Can you leave the corporate mogul at home? I laughed, realizing that after 15 years of hiding

who I was, I’d finally learned the difference between being invisible and being private. Of course, sweetheart,

but if she turns out to be investigating our family finances, all bets are off. Deal, he said, and I could hear him

smiling through the phone. For the first time in months, the future looked exactly as bright as I’d always planned

it would be. Thanks for listening. Don’t forget to subscribe and feel free to share your

story in the comments. Your voice matters.

News

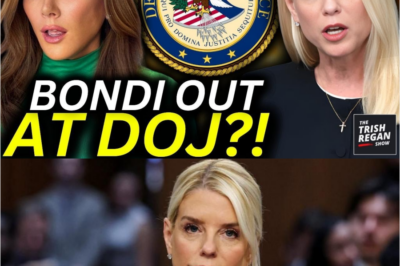

🚨 BREAKING: Pam Bondi reportedly faces ouster at the DOJ amid a fresh debacle highlighting alleged incompetence and mismanagement. As media and insiders dissect the fallout, questions swirl about accountability, political consequences, and who might replace her—while critics claim this marks a turning point in ongoing institutional controversies.

DOJ Missteps, Government Waste, and the Holiday Spirit Welcome to the big show, everyone. I’m Trish Regan, and first, let…

🚨 FIERY HEARING: Jasmine Crockett reportedly dominates a Louisiana racist opponent during a tense public hearing, delivering sharp rebuttals and sparking nationwide attention. Social media erupts as supporters cheer, critics react, and insiders debate the political and cultural impact, leaving many questioning how this showdown will shape her rising influence.

Protecting Individual Rights and Promoting Equality: A Congressional Debate In a recent session at Congress, members from both sides of…

🚨 ON-AIR DISASTER: “The View” hosts reportedly booed off the street after controversial prison comments backfired, sparking public outrage and media frenzy. Ratings reportedly plunge further as social media erupts, insiders scramble to contain the fallout, and critics question whether the show can recover from this unprecedented backlash.

ABC’s The View continues to struggle with declining ratings, and much of the blame is being placed on hosts Sunny…

🚨 LIVE COLLAPSE: Mrvan’s question, “Where did the data go?”, reportedly exposed Patel’s “100% confident” claim as false just 47 seconds later, sparking an intense on-air meltdown. Critics and insiders question credibility, accountability, and transparency, as the incident sends shockwaves through politics and media circles alike.

On March 18, 2025, during a House Judiciary Committee hearing, Congressman Frank Mirvan exposed a major FBI data security breach….

🚨 LIVE SHOCKER: Hillary Clinton reportedly reels as Megyn Kelly and Tulsi Gabbard call her out on live television, sparking a viral political confrontation. With tensions high, viewers are debating the fallout, insiders weigh in, and questions arise about Clinton’s response and the potential impact on her legacy.

This segment explores claims that the Russia investigation was allegedly linked to actions by the Hillary Clinton campaign during the…

🚨 MUST-SEE CLASH: Jasmine Crockett reportedly fires back at Nancy Mace following an alleged physical threat, igniting a heated public showdown. Social media explodes as supporters rally, critics debate, and insiders warn this confrontation could have major political and personal repercussions for both parties involved.

I’m joined today by Congresswoman Jasmine Crockett to discuss a recent clash with Republican Congresswoman Nancy Mace during the latest…

End of content

No more pages to load