Inside the Firestorm: How a $350,000 Payment and a Massive Life-Insurance Policy Sparked New Conspiracy Theories About Charlie Kirk’s Death

In the weeks following the shocking killing of conservative commentator and Turning Point USA founder Charlie Kirk, the internet has turned into a battleground of speculation, grief, and suspicion. Kirk, who was shot in September 2025 while at Apple Utah Valley, left behind a wife, Erica Kirk, two young children, and a massive audience stunned by the public execution of a political figure with millions of followers.

But as is common in the aftermath of any high-profile tragedy, conspiracy theories have erupted online, and the newest wave focuses on one explosive claim: that Erica Kirk allegedly received a $350,000 payment just weeks before her husband’s death.

A headline from Economic Times—a center-right financial publication known for its generally solid credibility—ignited the firestorm:

“Erica Kirk Received $350,000 Weeks Before Husband’s Assassination. Bizarre Claim Surfaces Online.”

The title alone was enough to send social media into chaos. But the story, once read in full, tells a far more complicated—and far less scandalous—narrative than the viral framing suggests.

The $350,000 Claim: What the Internet Got Wrong

Within hours, online commentators began suggesting that the payment was linked to a coordinated plan to murder Charlie Kirk. Hashtags pushed the idea that Erica was secretly paid off. YouTubers and TikTok political creators circulated the headline as “proof” of foul play.

But a closer look at both the Economic Times article and the financial records tells a drastically different story.

The article itself makes it clear:

The $350,000 was not a secret payout.

The claim stemmed from misrepresented financial documents circulating on social media.

There is no evidence whatsoever connecting Erica to her husband’s death.

And perhaps most importantly: the $350,000 figure is tied to life-insurance premiums—not to any suspicious personal transfer.

In other words, the headline was clickbait. The substance was not.

Yet, as pundit Adam Sosnick pointed out during a panel discussion, “This is the problem with flashy headlines: the insinuation sticks even when the facts contradict it.”

The Life-Insurance Bombshell

As online rumors grew, a content creator posted what they described as a “deep dive” into Turning Point USA’s financial filings. These documents—publicly accessible because TPUSA is a 501(c)(3) nonprofit—showed that in 2023 an entity called GGLF LLC paid $350,000 per year in premiums for a “split-dollar life-insurance policy” on Charlie Kirk.

The creator implied the timing was suspicious: Why take out such a large policy not long before his death?

But financial experts on the panel disagreed entirely—calling the framing misleading, sensational, and uninformed.

What the documents actually show:

GGLF LLC is owned by Charlie Kirk himself.

The policy was structured as a tax and estate-planning strategy—a common approach for high-net-worth individuals.

A 31-year-old non-smoker paying $350,000 per year could secure a death-benefit policy valued between $20 million and $50 million.

The purpose of such policies is often to protect the beneficiary from enormous estate taxes, not to prepare for wrongdoing.

The policy predates any online conspiracies and was likely associated with Kirk becoming a husband and father in recent years.

As one panelist bluntly put it:

“This is totally normal. This is exactly how high-net-worth life insurance works.”

In fact, several business leaders chimed in to say that similar “key man” policies are standard practice. When founders or CEOs raise millions or operate large organizations, investors often require such insurance.

“It’s the opposite of suspicious,” another analyst explained. “It’s responsible.”

Why the Conspiracy Theories Took Off Anyway

Despite experts debunking the financial claims, the speculation persisted. And much of that comes down to the intense scrutiny placed on Erica Kirk, who has faced severe online criticism for everything from her grieving demeanor to her clothing choices.

Her every move has been analyzed, judged, and weaponized.

One panelist expressed sympathy for Erica:

“Imagine losing your husband in the most public, brutal way possible—and then the world decides your tears aren’t good enough. People attack how you cry, what you wear, when you post. It’s inhumane.”

The scrutiny compounded when the $350,000 headline hit social media. The internet saw a number and instantly interpreted it as motive—without understanding context, legality, or standard financial practices.

To a typical person, $350,000 sounds like a shocking, life-changing amount.

To a multimillion-dollar organization or public figure with corporate insurance structures, it’s simply a yearly premium.

The Reality Behind the Viral Claims

The narrative circulating online suggests:

A mysterious payment.

A grieving widow benefiting financially.

A conveniently timed insurance policy.

But the verified facts show:

The $350,000 was an insurance premium—not a cash transfer to Erica.

The life-insurance policy was filed publicly in 2023, well before the tragedy.

Such policies are routine for CEOs and public figures.

No evidence—even circumstantial—connects Erica to the killing.

Economic Times did not accuse her of wrongdoing; online users misrepresented the headline.

Ultimately, the story is not one of hidden plots but of how misinformation thrives in the emotional aftermath of tragedy.

When Grief Meets the Internet

The death of any public figure spawns rumors, but the circumstances of Charlie Kirk’s killing—public, shocking, and politically charged—created a perfect storm. In the absence of answers about the motive or identity behind the assassination, many grasped at whatever fragments they could find.

And Erica, because she is visible and attached to his legacy, became an easy target.

Panelists repeatedly emphasized empathy:

“There’s no amount of money that would replace her husband or the life they built. The idea she had something to gain is insulting.”

Yet the cycle of speculation continues, fueled by clicks, algorithms, and the public’s appetite for scandal over nuance.

Conclusion: What We Actually Know

After weeks of analysis, only one conclusion can be drawn with certainty:

The $350,000 claim does not indicate wrongdoing—financially, legally, or ethically.

It was:

a routine insurance premium

connected to a standard estate-planning policy

publicly documented

misinterpreted by online commentators

sensationalized by misleading headlines

The conspiracy theories may generate views, but they crumble under scrutiny.

In the end, the real story is not about hidden payments or murder plots.

It’s about how quickly misinformation spreads—and how easily a grieving widow becomes the internet’s villain simply because the truth is less exciting than the fantasy.

News

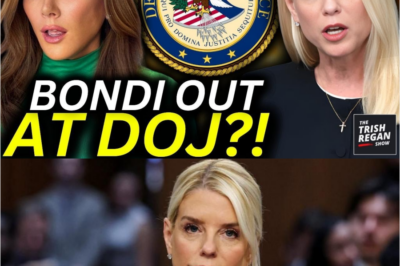

🚨 BREAKING: Pam Bondi reportedly faces ouster at the DOJ amid a fresh debacle highlighting alleged incompetence and mismanagement. As media and insiders dissect the fallout, questions swirl about accountability, political consequences, and who might replace her—while critics claim this marks a turning point in ongoing institutional controversies.

DOJ Missteps, Government Waste, and the Holiday Spirit Welcome to the big show, everyone. I’m Trish Regan, and first, let…

🚨 FIERY HEARING: Jasmine Crockett reportedly dominates a Louisiana racist opponent during a tense public hearing, delivering sharp rebuttals and sparking nationwide attention. Social media erupts as supporters cheer, critics react, and insiders debate the political and cultural impact, leaving many questioning how this showdown will shape her rising influence.

Protecting Individual Rights and Promoting Equality: A Congressional Debate In a recent session at Congress, members from both sides of…

🚨 ON-AIR DISASTER: “The View” hosts reportedly booed off the street after controversial prison comments backfired, sparking public outrage and media frenzy. Ratings reportedly plunge further as social media erupts, insiders scramble to contain the fallout, and critics question whether the show can recover from this unprecedented backlash.

ABC’s The View continues to struggle with declining ratings, and much of the blame is being placed on hosts Sunny…

🚨 LIVE COLLAPSE: Mrvan’s question, “Where did the data go?”, reportedly exposed Patel’s “100% confident” claim as false just 47 seconds later, sparking an intense on-air meltdown. Critics and insiders question credibility, accountability, and transparency, as the incident sends shockwaves through politics and media circles alike.

On March 18, 2025, during a House Judiciary Committee hearing, Congressman Frank Mirvan exposed a major FBI data security breach….

🚨 LIVE SHOCKER: Hillary Clinton reportedly reels as Megyn Kelly and Tulsi Gabbard call her out on live television, sparking a viral political confrontation. With tensions high, viewers are debating the fallout, insiders weigh in, and questions arise about Clinton’s response and the potential impact on her legacy.

This segment explores claims that the Russia investigation was allegedly linked to actions by the Hillary Clinton campaign during the…

🚨 MUST-SEE CLASH: Jasmine Crockett reportedly fires back at Nancy Mace following an alleged physical threat, igniting a heated public showdown. Social media explodes as supporters rally, critics debate, and insiders warn this confrontation could have major political and personal repercussions for both parties involved.

I’m joined today by Congresswoman Jasmine Crockett to discuss a recent clash with Republican Congresswoman Nancy Mace during the latest…

End of content

No more pages to load